Just spent the last month in a hectic world of remodel insanity. Had the floors refinished, so we spent a week in an extended stay hotel.

I am at the point of hating eating at any restaurant anywhere. Usually, I see it as a treat. Now, dining out is what you do when you have no kitchen. Now that I have a remodeled one, I have a re-inspired motivation to cook and enjoy kicking back at home.

It all has made me keenly aware of prioritizing my time. I only have so much time for so much life. A always wanted to run this financial blog, a food blog and one for vinyl record collecting. And as you can tell, I really have no time to write on this blog. The lack of hits is the result and that results in not wanting to put in the time.

BLOG CHANGES

That said, with this monthly update, this will be my last financial post.

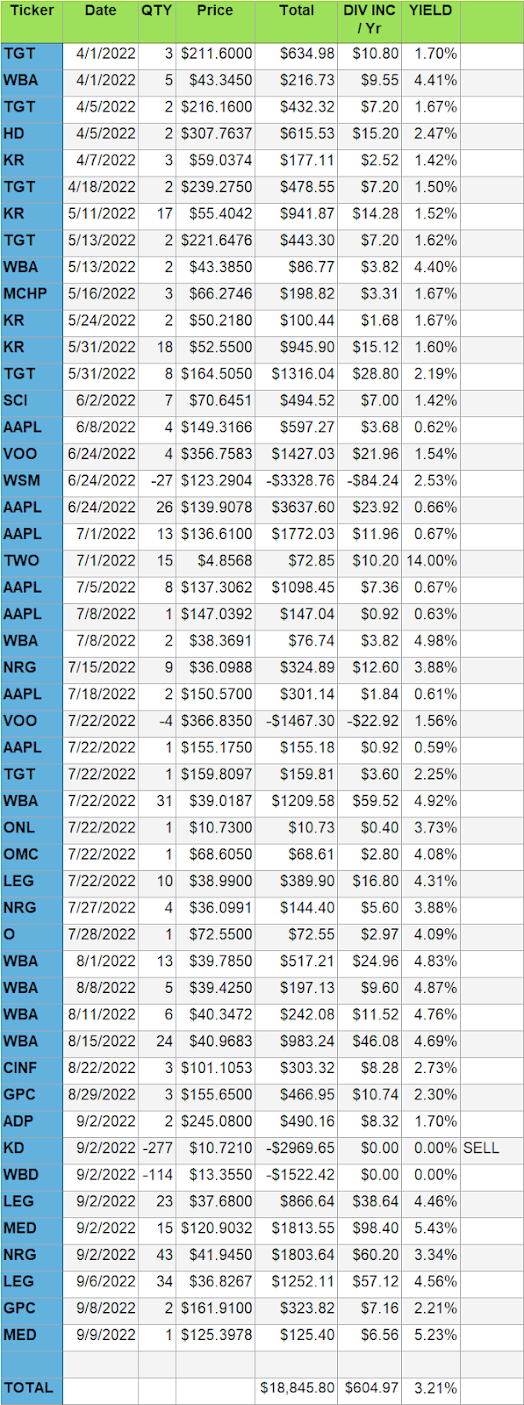

I have always been transparent with my finances. You can see the pattern of growth. I think this is enough info for others to see and will no longer be providing updates of my personal wealth. It's honestly too much work for too few views.

After beginning this financial blog since February of 2019, I've gained a tremendous amount of knowledge about finance, dividend investing, and running a blog.

The hardest part of those three is running a blog. Specifically getting hits. I mention I've always done this to primarily educate my daughter in the future about passive income. I believe I have provided the knowledge and track record I need for her to get a strong foothold in the future when she someday will take over my portfolio.

So this blog will now be drifting over to becoming a food and recipe based page.

I've always wanted to do that and feel the time and effort I put into this will be better served posting recipes I make at home. And I have a great new kitchen to do so.

THANKS

I want to thank those who have stuck with me through my journey. I am not going anywhere, as I am not going anywhere on social media like Twitter or Facebook / Instagram. I still am Chickenwizard on all platforms and can be found.

I am just not doing this anymore.

Soon, this blog will be taking on a new look. The financial stuff will be archived, but will no longer be the focus.

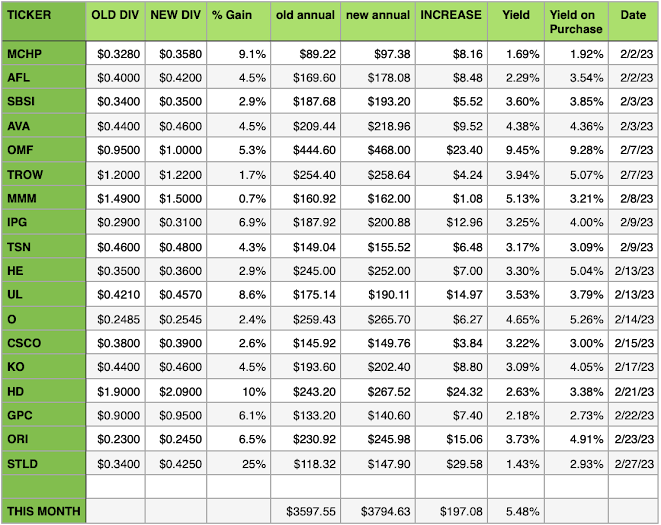

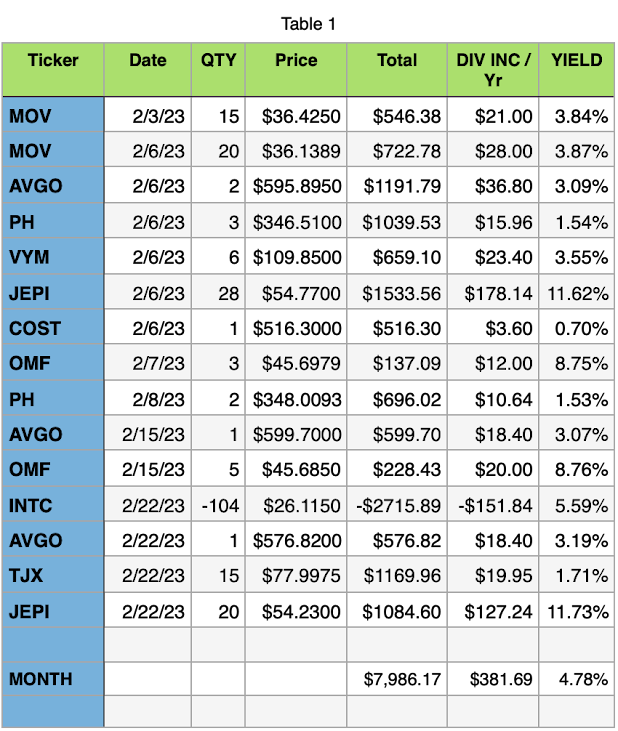

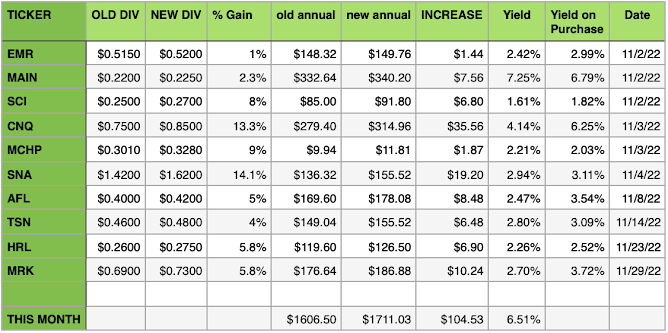

DIVIDENDS AND BUYS

Onwards.

In March I made $2,935.54 in dividend payments, up from the $2,680.00 in March of 2022. That's a 9.54% increase. I made ZERO buys in March. For the first time in years, I took my dividend earnings and paid for the refinishing of my floors. In my opinion, it is money well spent.

I am not posting a spreadsheet page.

Come back in a few months and check out my new look and content. Hope it does not suck

OVER AND OUT

.jpeg)

.jpeg)

.jpeg)

.png)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)