I will sound like a broken record as to why I have not blogged in a month again. Another SUPER busy month just flew by...

Really. Let me explain....

Our home, a cute little 1918 craftsman bungalow, has been showing some signs of wear and tear over the past couple years. The original Douglas Fir floors are really beat up, the main floor bathroom tub looks beaten. The kitchen countertop plywood underlayment is rotting, so the sink will soon fall onto the floor, the fridge is dying, and the old fridge is only 30" wide, so replacing it has very limited options. Look at this beat up floor and formica..

So for the past month, we've been in the middle of planning out a full remodel of the kitchen, moving the sink and stove so we have longer counter runs and much more cabinet space. It requires plumbing and electrical moves. That means we pull up the crappy warped oak floor and replace it with a new laminate floor. Here are the renderings..

Lots more counter space!

The bathroom will get a new tub, toilet, flooring, and tile walls.

After that, the main floor doug fir floors will be repaired and refinished. Then new paint.

It's not cheap and with the interest rate on a loan for these repairs being as it is, I will be cashing some of my lower yield shares to pay for it. We are thinking it all is in the $80K range for the whole process. And that is why I have not written anything. Excuses, excuses..

Also, I am introducing a new format for posting updates. Instead of having separate posts for dividend income, new buys, and dividend increases, I will summarize it in one post. So here goes!

DIVIDEND INCOME

November was another fantastic month. I received 35 payments for $1,552.73. That's an increase of $485.94 over the $1,066.79 in November of 2021. A 45.5% increase year to year. I'm liking seeing the combination of increased dividends, reinvesting every penny, and adding at least $1,000 per month to the fund. The result is stunning growth. Here are the details below.

Not too shabby. Hopefully, the remodel will not sink it too much.

DIVIDEND INCREASES

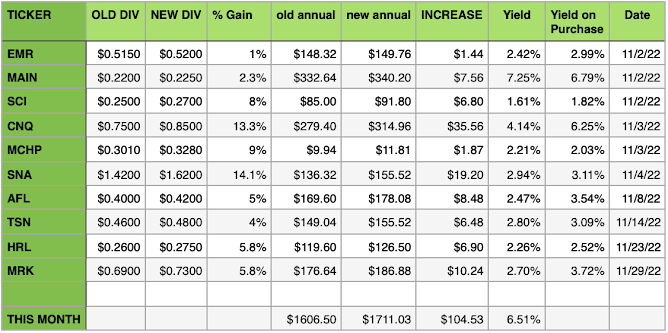

Last month I sat a total of $104.53 of increased annual dividends announced . I may have missed one somewhere, but a nice total. The average of the increases was 6.51%. Snap-On (SNA) was the home run with a 14.1% hike. Sweet! Here's the nitty gritty.

STOCK BUYS

Last month I bought $1,788.47 of good companies that pay shareholders an ever increasing dividend. I ended the month with a stash of cash that I proceeded to buy more the first few days of December, but that is for next month's report. This resulted in adding $51.82 of annual dividend income.

The big buy was starting a new position in Restaurant Brands International (QSR). The company that owns Burger King, Tim Hortons, Popeye's, and Firehouse Subs had been on my watch list for a while now and felt it was time to pull the trigger. They have a nice track record of beating quarterly estimates, have a moderately low P/E ratio, a dividend payout ratio that's in the upper end of the swet zone at 70%, and a dividend growth rate of 21% over the past 5 years and should be due to increase it again, fingers crossed. Glad I got them.

The other purchases were additions to earlier holdings that I am inching towards my goal of a $5,000 cost basis per holding. Here are the details.

Sticking with a plan to continually buy dividend growth stocks, reinvesting all dividend income, and having a large moat of holdings has resulted in inchin closer and closer to my goal of replacing my work income with passive income. I went from almost no dividend income to over $2,250 per month average in 9 years. In 10 years, I should be at my goal and will only want to work to save money on health insurance until social security kicks in.

If a shopping addicted neandertal can do this, you can too!

See ya!

.png)